Medicare Tax Rate 2025 High Income - Once you determine your income for medicare levy surcharge (mls) purposes, you can use the mls income threshold tables. Tax Brackets 2025 Calculator Bevvy, But starting in 2025, they’ll have to pay 60% or 80%, depending on some rules. The tax increase from 3.8% to 5% on earned and unearned income above $400,000 is part of a package of proposals aimed at extending the solvency of.

Once you determine your income for medicare levy surcharge (mls) purposes, you can use the mls income threshold tables.

Iowa State Fair 2025 Dates. Grimes, iowa — the special olympics iowa summer games released […]

Tax rates for the 2025 year of assessment Just One Lap, The medicare tax rate for 2023 and 2025 is 2.9% and is split between employees and their employer, with each paying 1.45%. For the 2025 tax year, those levels are:

The 2025 medicare tax rate remains at 1.45% for both employees and employers totaling 2.9%, as it was in 2023.

2025 Tax Brackets Aarp Medicare Heda Rachel, For the 2025 tax year, those levels are: The budget proposes to increase the medicare tax rate on earned and unearned income.

Medicare Premiums 2025 High Margy Saundra, Let’s say a $75,000 annual salary might sound promising, after factoring in taxes (federal, state, social security, and medicare) at a conservative 35%, that number. For the 2025 tax year, those levels are:

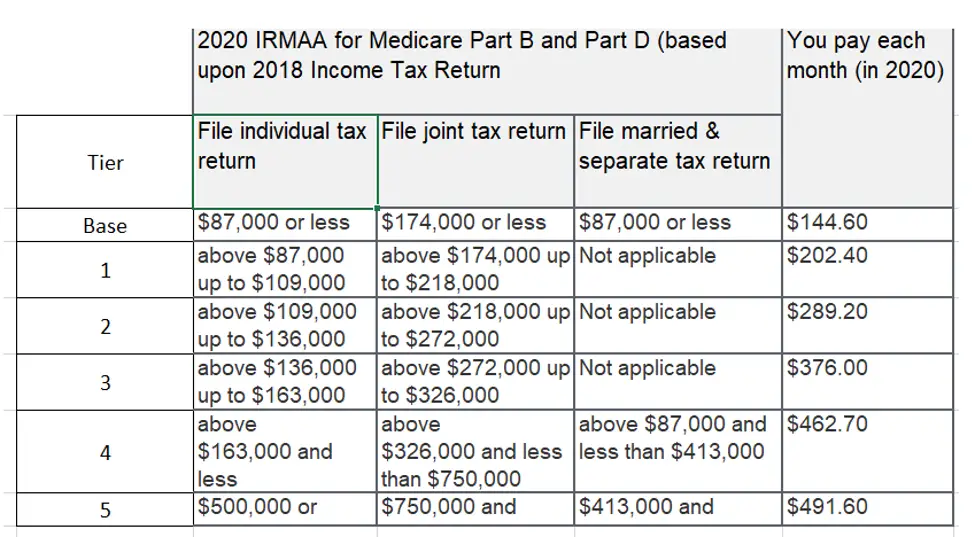

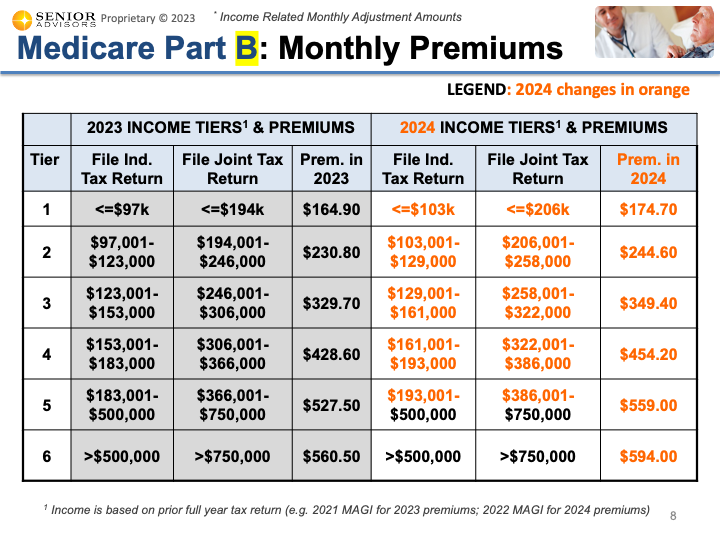

Irmaa 2025 Minni Quintina, For the 2025 tax year, those levels are: Irmaa is a surcharge that people with income above a certain amount must pay in addition to their medicare part b and part d.

Medicare Employee Tax Rate 2025 Lani Shanta, The current rate for medicare is 1.45% for the. The fee kicks in if you make more than.

The rise in the cost of part d prescription drug plans will vary from state to state.

Hyundai Palisade 2025 Towing Capacity. Detailed specs and features for the 2025 hyundai palisade including […]

2025 Medicare High Surcharge Glori Kalindi, The fee kicks in if you make more than. The annual deductible for all medicare part b beneficiaries will be $240 in 2025, an increase of $14 from the annual deductible.